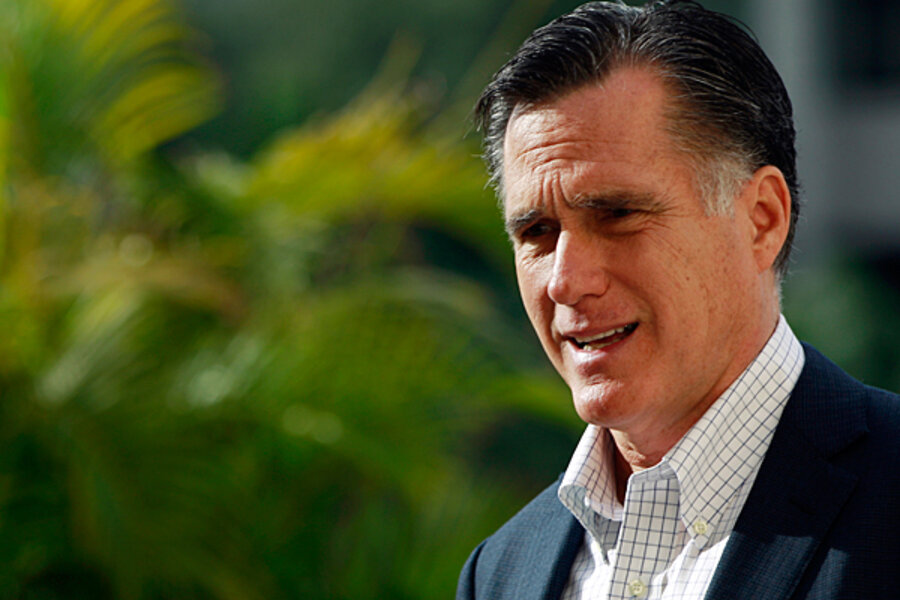

Mitt Romney to release his taxes: beyond the obvious ($$), six things we can learn

| New York

When Mitt Romney releases his tax returns for 2010 and his estimated taxes for 2011 Tuesday, tax experts expect it will be a relatively complicated return with schedules and forms that most Americans will never have to fill-out.

As William Gale, a fellow at the Brookings Institution, sees it, Romney’s tax return will provide an “opportunity to understand how high-income people navigate the tax system.”

In a statement, Romney spokeswoman Andrea Saul says the release, which is expected in the morning, will show that “Governor Romney pays millions in taxes each year, that he gives millions in charitable contributions, and that his investments are reported and taxed in full compliance with US tax law. Governor Romney has paid 100 percent of what he has owed.”

Here are six key things to watch for:

How much tax did he pay relative to his income?

One simple way to measure this would be to look at Mr. Romney’s tax liability divided by his adjusted gross income. At a recent press conference, Romney said he thought his tax rate would be about 15 percent.

However, some tax experts think it might be even lower. “His tax rate is likely to be substantially below 15 percent,” says Roberton Williams of the Tax Policy Center, a non-partisan group that looks at tax policy, in Washington. “It could be as low as 13 percent,” he says.

On Monday, Warren Buffet, speaking to Bloomberg Television, said he did not fault the Republican presidential candidate. “He will not pay more than the law requires,” said Mr. Buffet.

According to Romney’s comments in the recent past, his cash income would come from his speaking fees which he estimated at $370,000, plus some royalties on books.

But, the largest amount will come from long-term capital gains and dividends, taxed at 15 percent, from his time at Bain Capital, which he headed up from 1984 to 1999. On Tuesday, Romney will reveal how much that amounted to in the past two tax years.

How much did Romney take off his tax bill from itemized deductions?

Romney, who is a bishop in the Mormon Church, has said he gives a tenth of his income to his church. That could be a significant amount. In addition, as a resident of Massachusetts, he can deduct his state income tax. And, as the owner of three homes in high-priced neighborhoods, he can deduct his property taxes.

It’s important to know Romney’s deductions because those will reduce the amount of his income. “His deductions may totally wipe out his cash income,” says Mr. Williams.

Does Romney have any Alternative Minimum Tax (AMT) liability?

Millions of Americans have to figure out line 45 on the form 1040. The AMT, which was introduced in 1982 with the goal of preventing the wealthiest Americans from avoiding taxes through multiple deductions, basically imposes a flat tax rate on income above a certain exempted level. Regular income tax allows certain deductions, such as state income tax. The AMT has a built-in exemption level but does not allow taxpayers to deduct certain things such as medical expenses and state taxes. Romney’s accountants will reveal whether he has any AMT liability.

Will Romney reveal details of any investments held in a blind trust?

According to Williams, he is not required to list the investments per se. He may just show gross amounts, such as how much capital gains he has without showing how he made them.

“I suspect there won’t be a lot of information on the exact pieces of his income,” says Williams.

How many years of his taxes will he release?

When Mitt’s father, George Romney, ran for the Republican nomination for president in 1968 against Richard Nixon, he released 12 years of his tax filings.

“It would be really interesting to see the prior years,” says Williams.

Romney told Fox News on Sunday he will only be releasing his 2010 taxes and an estimate of his 2011 taxes.

How else will the Romney taxes be useful?

Mr. Gale, the Brookings fellow, does not think the tax forms will show Romney has done anything illegal. But, he says, the form is “likely to show how someone legally avoids taxes.”