Credit-card bill could hit students hardest

Loading...

| Washington

The credit-card reform bill expected to clear the Senate Tuesday signals big changes in how Americans use credit, but no group will feel the impact of these changes as much as students and consumers under age 21.

On the one hand, the new law promises them the same protections it promises to the nation as a whole: more transparency, less-arbitrary rate hikes, fewer surprises in the small print. It also adds special protections for young consumers.

But may this may come at a price: less access to credit, especially among young people – precisely at a time when they are becoming more dependent upon it. Half of college students have four or more cards and are carrying an average balance of $3,173 – a record, according to the most recent survey on credit-card usage by student-loan giant Sallie Mae.

“The bottom line is that young adults are plunging into credit-card debt, in particular, on campus,” said Christine Lindstrom of US PIRG, a federation of public-interest groups, during a teleconference Monday to support passage of the bill. “Unfortunately, on campus, however, they’re targeted with cards that have terrible terms and conditions, and these cards are aggressively marketed to them.”

The Senate version of the bill bans credit-card companies from issuing cards to consumers younger than 21, unless a parent agrees to accept financial liability for the card or the applicant can show an independent means to repay.

In addition, it limits preapproved offers of credit to young consumers and prohibits increases in the credit limit unless someone who is jointly liable approves the increase in writing.

A House version of the bill, which passed on April 30 on a bipartisan 357-to-70 vote, bans issuing credit cards to consumers under age 18 unless a parent or guardian is the primary account holder or state law allows it.

For full-time college students between the ages of 18 and 21, credit extended in any year may not exceed either $500 or 20 percent of the student’s gross income.

Harder economic times have brought mounting calls to curb predatory lending directed at students. In extreme instances, students are being forced to drop out of school to catch up with their credit cards.

“It’s our understanding from the colleges we hear from that they are understandably distressed over the number of academically sound students who have to drop out of school to service their credit-card debt,” says Gail Cunningham, a spokeswoman for the National Foundation for Credit Counseling in Silver Spring, Md.

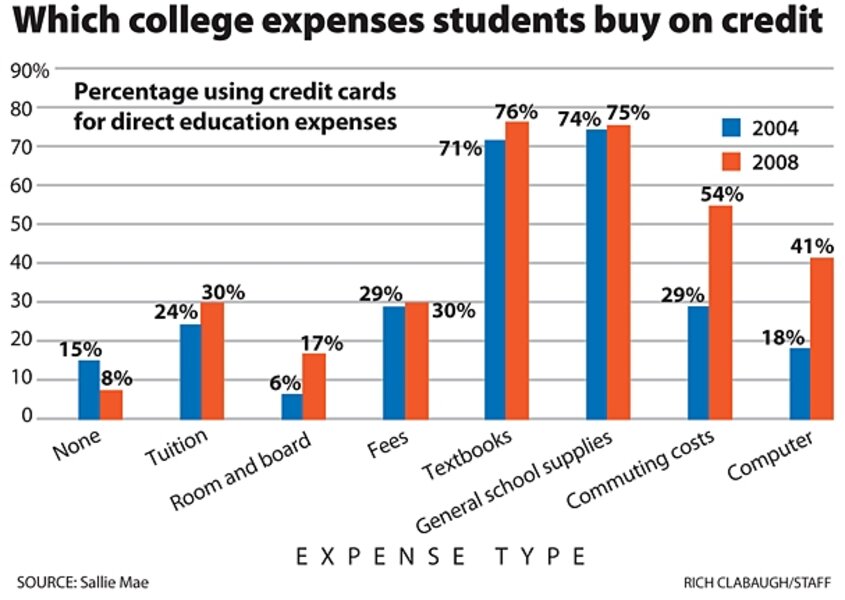

Nearly one-third of college students put tuition on their credit cards, up from 24 percent in 2004, according to the Sallie Mae survey. More than three-quarters carried a monthly balance and the fees that go with it. [Editor's note: The original version attributed the Sallie Mae survey to the wrong organization.]

Consumer groups and some student activists say the reforms will be a boon to students, who often rack up unsustainable balances and fees without fully understanding the financial burdens they are taking on.

"Just because credit-card companies are taking a hit ... doesn't mean that they should be allowed to give thousands of dollars to young people with no way of paying it back," said Carmen Berkley, president of the United States Student Association, also on the teleconference on Monday.

"Of course, students still need credit cards," she said. "I myself received a credit card at 18 with a consolation prize of a T-shirt. I needed it for food, for books, for living expenses."

The shock came when she reached her credit limit and interest rates skyrocketed. "Then, I had no way of paying it back," she added.

Tessa Atkinson-Adams, a senior at the University of California, Santa Barbara, recalls seeing an invitation for free pizza at a restaurant just off campus during her sophomore year. "Credit-card companies were banned from setting up tents on any UC campus, but they found a way around it," she says.

"Turns out, you had to fill out a form to get the pizza," she says. "It was a credit-card application, and I still get e-mail almost every day from all these different credit-card companies, just because I wanted to get a free plate of pizza."

But banking groups say the legislation could wind up harming the consumers it seeks to help by reining in credit to young people who need it.

“It doesn’t strike the right balance between enhancing consumer protections and ensuring that credit cards remain available,” says Peter Garuccio, a spokesman for the American Banking Association. “Clearly, it will limit their access to credit."

It also represents government meddling, some say. “Should the government be treating you differently if you’re 20 or 22?” says Mark Calabria, director of financial regulation studies for the Cato Institute, a libertarian think tank in Washington.

“The purpose of any form of credit is to borrow against your future earnings in order to enjoy some consumption today," he adds. "Whether that consumption is in the form of textbooks or beer and pizza should be left up to the individual – we are talking about adults here – and not the state.”