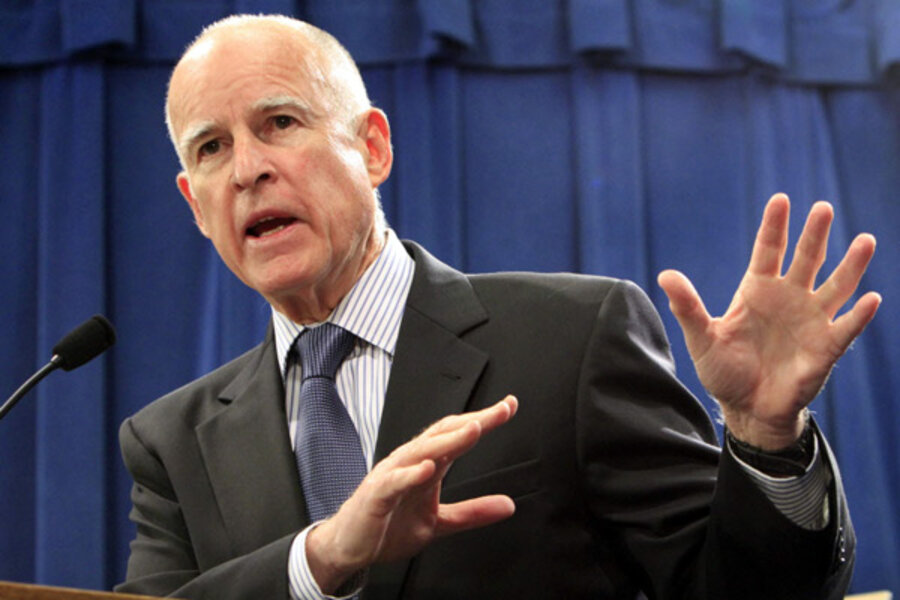

Should California sell property to raise cash? Jerry Brown calls off a deal.

Loading...

| Los Angeles

Gov. Jerry Brown, who has been receiving kudos from political analysts for sticking to his promises on how to turn California’s fiscal fortunes around, said Wednesday he will forego the sale of 11 state buildings to raise cash, a move that “didn’t really make much sense.”

The sale of the buildings, which would have netted $1.2 billion to help plug California’s budget deficit of $25.4 billion, was negotiated by the administration of former Gov. Arnold Schwarzenegger.

Following the deep recession, several states have been considering the sale of state properties to close record budget deficits, among them Pennsylvania, Arizona, and Connecticut. But Governor Brown came to office determined to put his foot down and get America’s most populous state to stop making national headlines every year for what he considered its dysfunctional approach to finance.

State budget woes: How much will they drag down US economy?

Under the Schwarzenegger administration’s plan, state offices would have remained in the buildings after the sale and the state would have continued paying rent.

“The sale of the buildings didn’t really make much sense,” Brown said at morning press conference in Sacramento. “It is in effect a gigantic loan with interest payments equal to 10 percent every year.” Experts say Brown has been listening carefully to economic advice from outside his administration.

“The sale would make sense only if you assume that we’re desperately short on money today but will be flush with cash in the years ahead,” says Jack Pitney, professor of government at Claremont McKenna College. “Brown is acknowledging that there is no pot of gold at the end of the rainbow. [Selling the buildings would be] the economic equivalent of a sugar high, and Brown wants to put the state on a diet.”

Professor Pitney points out that Brown heeded counsel from the state’s independent Legislative Analyst’s Office, which concluded last year, “After taking into account the one-time revenue that the state would receive in the first year and converting the future costs into today’s dollars, we estimate the transaction would cost the state between $600 million and $1.5 billion.”

Analysts agree with Brown’s assessment that the transaction would have provided needed cash immediately, but cost Californians money over the long term.

“This sale fits in with Brown's campaign promises to have no gimmicks and no smoke and mirrors when it comes to the budget,” says Barbara O’Connor, director of the Institute for Study of Politics and Media at California State University, Sacramento.

The sale would have included the Junipero Serra State Building and Ronald Reagan State Building in downtown Los Angeles. The Los Angeles Times reports that Brown is proposing internal borrowing from state funds at a lower rate to cover the money that would be lost this year by canceling the sale.

"We found an alternative that can save a lot of money," he said.