The once-formidable corn-based ethanol lobby took hits in both the House and Senate on Thursday – a shift that opens the door to critics challenging taxpayer subsidies for other energy sources, such as oil and wind.

On Thursday, the Senate voted 73 to 27 on a bipartisan measure to eliminate $6 billion in annual tax subsidies for ethanol producers. Thirty-three Republicans joined 38 Democrats and 2 Independents in support of the measure. Opposition came from 13 Democrats and 14 Republicans, mainly in Midwest corn states.

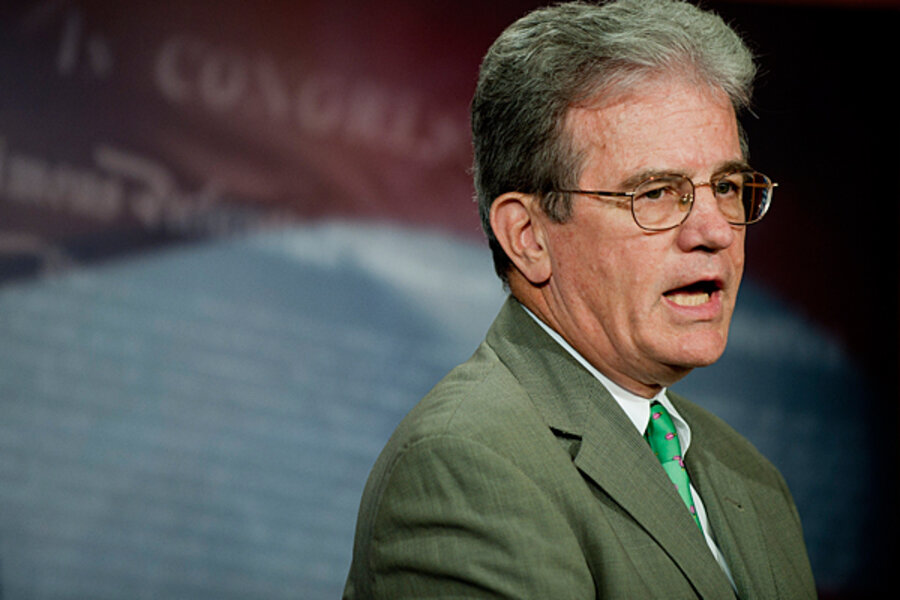

“Today’s vote was a major victory for taxpayers and a positive step toward a serious deficit reduction agreement, which is our only hope of averting a debt crisis,” said Sen. Tom Coburn (R) of Oklahoma, a cosponsor of the measure with Sen. Dianne Feinstein (D) of California.

“An overwhelming bipartisan majority of senators embraced pro-growth tax reform while rejecting the parochial politics that so often paralyze the Senate. The best way to reduce our crushing $14.3 trillion debt is by reducing wasteful spending a billion dollars at a time,” he added.

Though the bill to which the amendment is attached has little chance of becoming law, the vote marked a path forward for Senator Coburn and other deficit hawks.

In a related move, the House voted 283 to 178 on an amendment to ban the US Department of Agriculture from funding ethanol infrastructure, including blender pumps and storage facilities. In response, freshman Rep. Kristie Noem (R) of South Dakota introduced a bill that includes one of the provisions from the Senate bill but seeks to soften the impact. The bill would end a 45-cent-per-gallon ethanol excise tax credit on July 1, but would use the savings to fund ethanol-delivery infrastructure as well as pay down the deficit.

“I am as concerned about our deficit as any other member of Congress, but we cannot hang the ethanol industry out to dry with such a drastic policy change, so quickly with so little debate,” she said in a statement after the vote.