Will GOP's tax reform prove easier than health care?

The Republican Party couldn’t repeal and replace Obamacare like it promised. Still smarting from that setback, the GOP is turning to another daunting issue: tax reform.

Perhaps taxes will be easier than health care. Tax cuts are a unifying issue for the party, after all. And questions of tax reform are heavily transactional. Solutions involve moving numbers around to make lawmakers and interest groups happy. There are fewer philosophical questions about the nature of government’s role.

But tax changes do produce winners and losers among business and demographic groups – and the losers fight. Plus, Republican unity may be affected by the finger pointing that has followed the collapse of the health-care effort. Or rather, the lack of Republican unity may have been exposed. That might be the big lesson from last week’s extraordinary events.

“The real obstacle to the passage of health care reform [was] the Republican Party itself, and any full reckoning with what just happened has to grapple with that fact,” writes Boston College political scientist David Hopkins on his Honest Graft blog.

Who’s to blame? That was a big question in Washington over the weekend following Friday’s stunning collapse of the GOP’s American Health Care Act (AHCA) in the House.

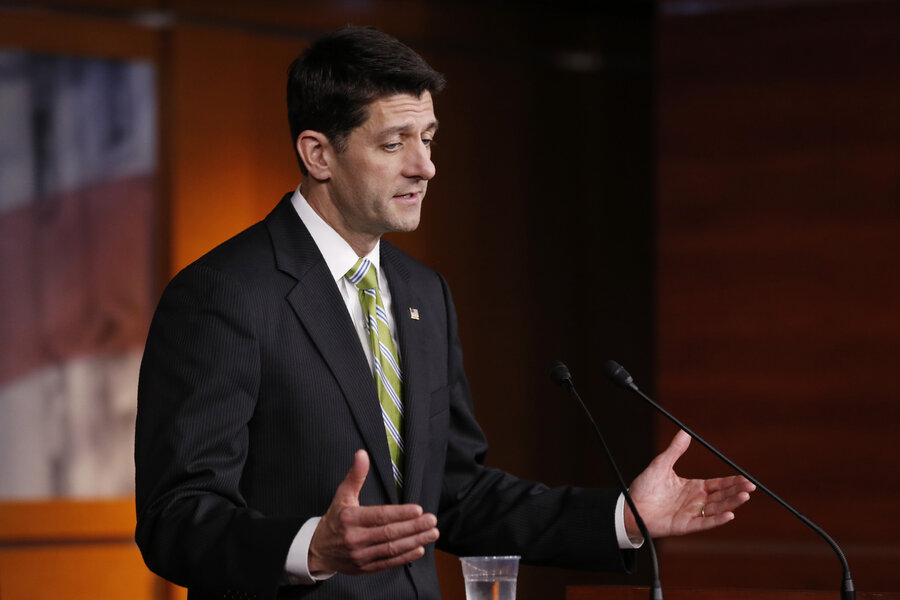

President Trump said Democrats were at fault for the debacle, and on Twitter took a shot at the conservative House Freedom Caucus and outside groups such as the Heritage Foundation as well. Meanwhile, members of the House Freedom Caucus pointed at House Speaker Paul Ryan and moderate Republicans. Those moderates said the bill itself was just too flawed to pass.

Office of Management and Budget Director Mick Mulvaney blamed the city. “I think what happened is that Washington won. Washington is a lot more broken than Mr. Trump thought it was,” he said on NBC’s “Meet the Press” on Sunday.

Washington reality

Whatever the proximate cause, the AHCA flop may have exposed several underlying aspects of America’s current politics, according to experts.

One is that unified government – one-party control of the House, Senate, and White House – isn’t as powerful as it seems. Despite its wide House majority, the Republican Party couldn’t get a high-priority piece of legislation through the House due to splits among factions. The Senate, where the party has only a two-seat margin, would have been even more difficult. In that situation the relative power of splinter groups compared with the party leadership is high.

Another is that Trump isn’t the boss of Congress. In part, this is due to his particular position. His approval ratings are low, and his positions on health-care specifics weren’t clear. Members of the House Freedom Caucus did not seem all that worried that he would be able to affect their reelection or would even try to do so a year hence.

In part, Trump’s relative lack of effect is due to the fact that presidents in general aren’t as powerful as the public often thinks. As presidential scholar Richard E. Neustadt has famously argued, a president’s main power is simply to persuade.

“In short, presidents can’t order members of Congress to do things,” writes Bowdoin College government professor Andrew Rudalevige in the Monkey Cage political blog.

A third aspect of US government at play in the AHCA affair is the simple premise that context matters, according to Professor Rudalevige. Lawmakers defer to presidential authority in a crisis. But despite Trump’s insistence that Obamacare is a “disaster,” the timing and nature of the replacement bill seemed driven by mundane aspects of legislative requirement. Much of the bill was structured so that it would not be subject to filibuster in the Senate, for instance.

All these things will continue to bedevil the Trump administration as it turns to the next big items on its legislative agenda.

Tax reform will take time

In the past Trump officials have said they want tax reform wrapped up by August. Trump himself has seemed more eager to talk about coming tax cuts than health care at rallies.

But a big tax bill might take more time than that. The last time a major tax reform passed Congress, in 1986, it took about 323 days from introduction to finish, pointed out NBC’s Chuck Todd on Sunday.

And Speaker Ryan’s current tax-reform framework depends heavily on a “border adjustment tax,” a complicated 20 percent levy on imports intended to encourage domestic manufacturing while raising enough revenue to pay for reductions in corporate and personal income tax rates. The border tax divides industry from industry – big box consumer retail chains that sell largely imported merchandise hate it. It’s unlikely to sail through the House.

Trump at times has sounded skeptical of border tax virtues. But he’s on board with it now and still sees it as a major part of any reform package, his chief of staff, Reince Priebus, said on Fox News Sunday.

“I think that moving forward, the president’s vision on lowering taxes for every American is what’s going to unite not just the Republican Party, but I think some of those Democrats are going to come on board as well,” said Mr. Priebus.

Will the House Freedom Caucus play the role of spoiler on tax reform, as it did with health care? It’s possible the group will oppose the border tax part of the package. That’s due to their philosophical opposition to pretty much any new form of revenue enhancement that can have “tax” slapped on it as a descriptor.

But Priebus is correct that lowering taxes unites the GOP in a way that fiddling with the government’s role in health care never has. A general package of tax reductions would likely sail through the House and Senate. One important indication of this is that Freedom Caucus chair Rep. Mark Meadows (R) of North Carolina has said a tax-cut bill would not have to be paired with deep spending cuts to ensure it does not increase deficit spending.

“Does it have to be fully offset? My personal response is no,” he said Sunday on ABC.