How Haiti is fighting poverty by killing cash

Loading...

In Haiti, cash is escaping from wallets and savings accounts are breaking free from brick-and-mortar banks.

Two years after 2010’s devastating earthquake, mobile money has taken off in the island nation. While the country has seen setbacks in many areas and continues to struggle, one bright spot is the transformation of the country’s traditional banking sector.

Physical banks were wiped away by the quake and subsequent hurricane, and a mobile banking network that uses cell phones has grown up in their place.

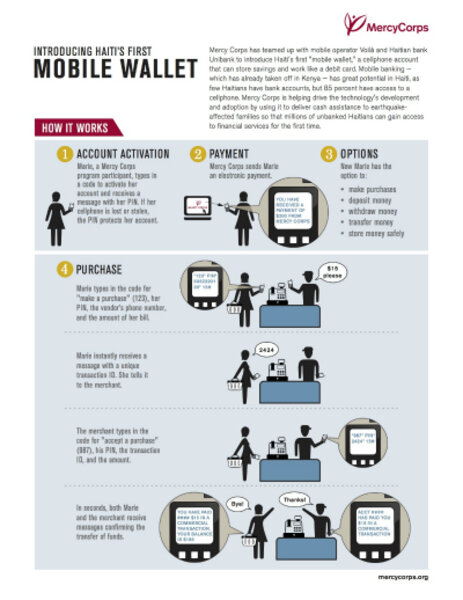

Toting your money around on a cell phone might sound scary, but for many Haitians it’s more secure than carrying around a wallet, which isn’t protected by a PIN. The handy infographic to the left shows how a mobile money transaction works.

RELATED: Five tasks for Haiti's new pop-singer president

In the months following the quake, both Mercy Corps (our parent organization) and The Gates Foundation sponsored separate Haitian cell phone companies, Voilà and Digicel, to help mobile money take off, with the Gates Foundation offering monetary incentives for the first company to get a program off the ground and for continued improvements in order to get entrepreneurial engines revving.

For many Haitians, mobile money can open a door to personal choice. Mercy Corps has used mobile money to distribute food aid to families across Haiti and deliver payments from its cash-for-work programs. Instead of spending hours waiting in line for a cash payment or a food ration, Haitians receive a wireless money transfer on their phones once a month.

The technology holds promises for the future, too. Long-term, mobile money could be expanded so that it’s accessible to everyone for all of their personal purchases. Haitians could use mobile money to send remittances to family members in other parts of the country, according to AudienceScapes. And after visiting with Mercy Corps staff in Haiti in 2010, New York Times columnist Nicholas Kristof wrote about the way that mobile money is creating a way for the poor to save money like never before. Most banks won’t accept very small deposits, but now a mobile phone could double as a savings account. It could blow the microsavings sector wide open.

Mobile money could also help make Haitians healthier. Even before the earthquake hit, Haiti’s public health indicators were the worst in the Western hemisphere, according to the US Department of State, and those problems were only compounded by the disaster.

In Kenya, one of the first countries to adopt mobile money, customers can use it to pay – and save up for – health services. Expectant mothers use it to save for health care, and in rural communities Kenyans have used the service to pay for access to clean water, reports USAID. Looking forward, a mash-up of mobile health and mobile money technologies in Haiti could lead to new insurance plans and health voucher programs, according to Health Unbound.

With mobile money quickly gaining widespread use, the developing world is leaps ahead of the developed. Mobile money launched in Kenya in 2003, according to The National Archives, but Google Wallet’s similar service in the United States wasn’t released until September of last year and has yet to truly take off. Maybe it’s time for American company executives to start taking a few pointers from Haiti.

• This article first appeared at Global Envision, a blog published by Mercy Corps.

• Sign-up to receive a weekly selection of practical and inspiring Change Agent articles by clicking here.