OPEC announces historic cuts to buoy oil prices

| Cairo

In a bid to confront rapidly sliding oil prices, which have dropped 40 percent from July highs amid collapsing demand, OPEC members announced historic cuts at their meeting in Algeria on Wednesday.

Oil ministers attending the Organization of Petroleum Exporting Countries meeting will slash production by 2.2 million barrels per day (b.p.d), the largest single reduction in the group's history and more than expected ahead of the gathering. It follows a November production cut of 1.5 million b.p.d.

Oil prices have plunged since July, when crude traded at $147 a barrel. By midafternoon Wednesday, it was trading at $43.24 on the New York Mercantile Exchange.

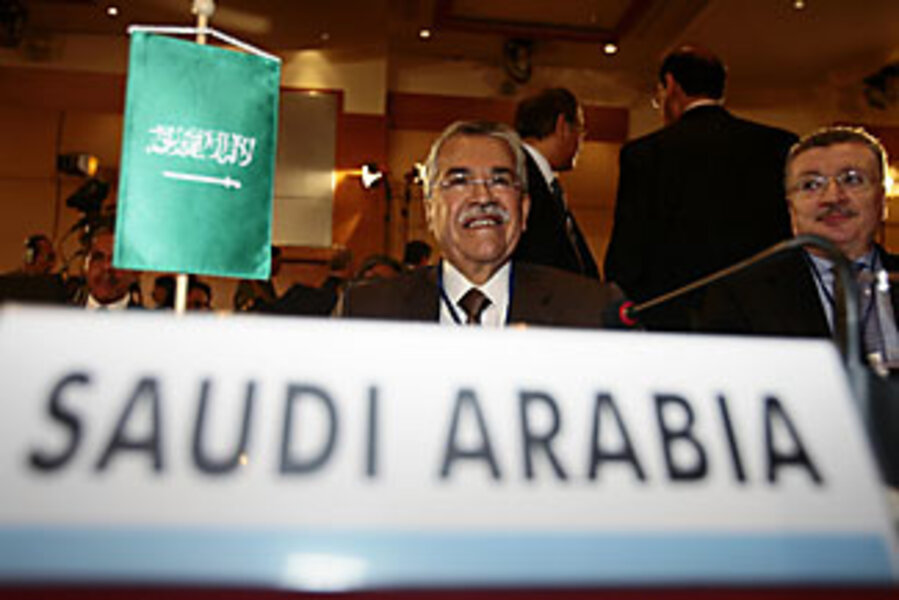

"Supply is still somewhat in excess of demand," Saudi Oil Minister Ali al-Naimi told reporters in Oran, Algeria, according to the Associated Press. "To bring things in balance, there will be a cut to the tune of about 2 million barrels."

Saudi Arabia is the most influential member of the bloc, which includes other heavy-hitters like Kuwait, Qatar, Iran, Nigeria, and Venezuela.

While oil markets had little reaction to the announced cut Wednesday, many analysts remain cautiously optimistic that oil prices could begin to stabilize at a higher level.

Vincent Lauerman, president of the Calgary, Canada-based Geopolitics Central, said the historically large cut could drive prices back above $70 a barrel. "OPEC, and in particular the Saudis, should be congratulated for finally acting less like a supertanker reversing direction and more like the US Federal Reserve fighting the global financial crisis."

But he cautions that oil prices are closely tied to the health of the larger global economy and that they could swing sharply lower based on the length of the worldwide recession.

"If the global recession is long and deep, we will see new lows for oil prices, probably sub-$20 per barrel on the spike downwards," he says. "OPEC is only going to cut so many barrels."

Some large oil producers outside of the cartel also pledged production cuts Wednesday, including Russia and Azerbaijan, which said they would each take 300,000 b.p.d off the market, according to Russian state media. Others, such as Mexico and Norway, have declined to commit to any production cuts.

"The non-OPEC producers that have also agreed to make cuts are unlikely to do so in any significant way," says Mr. Lauerman. "Production already tends to be declining in these countries for various reasons, and they will simply count this towards their announced cuts."

Efforts at coordination among producers highlights the growing concern among the world's oil producers, says Olivier Jakob, energy analyst at Zug, Switzerland-based Petromatrix. With oil revenues falling so quickly, the price of investing in new technologies and oil fields has become prohibitive for many producers, who have also seen government revenue adversely effected.

Lower prices may be a relief to some consumers looking to fill up their gas tanks or heat their homes. But Mr. Jakob warns that if too many new developments are derailed by the price plunge, it may be consumers who pay when prices eventually push higher and supply has dried up.

"In the long run, if too many projects are pushed back, then when prices eventually do bounce back that will create greater pressure on OPEC," he says. "They need to find a price level at which supply and demand can reach a steady equilibrium."

Several members of OPEC, which pumps more than a third of the world's oil, said at least 2 million barrels needed to go from daily output to prevent a massive buildup in inventories.

"A minimum of 2 million, we think, needs to be cut so we can balance the market," Iraqi Oil Minister Hussain al-Shahristani told Reuters.

The cut, the third this year, brings a total reduction in OPEC supply to 4.2 million b.p.d, nearly a 5 percent cut in world oil supplies. OPEC has encouraged other producers to cut back, too. Russia and Azerbaijan are attending the Oran meeting as observers and have said they could rein in exports in future, but stopped short of am immediate pledge.

Leading a high level delegation, Russia's Deputy Prime Minister Igor Sechin said in a speech to OPEC that Moscow did not plan to join in coordinated output cuts and did not want to join the group.

Oil below $50 a barrel is uncomfortable for all producing nations, but especially for OPEC members Venezuela and Iran, which are dependent on higher prices to fund ambitious domestic programs.

It is hoped that a sharp supply cut will put oil on the path toward $75.

"You must understand the purpose of the $75 price is for a much more noble cause," the Saudi oil minister said. "You need every producer to produce, and marginal producers cannot produce at $40 a barrel."

"Therefore we believe that $75 is probably more conducive to marginal producers to continue so we don't have a shortage in the market and we avoid the future sky-rocketing of prices."

Analysts said a limited recovery in prices would put a bit more strain on a recessionary global economy, but it may help pull the world back from the brink of deflation – a growing source of concern.

• Material from Reuters was used in this report.